Financing real property investments is extraordinarily important for any property investor. After you submit your utility, the database matches your information with lots of of economic mortgage financing packages. Your industrial real estate mortgage will probably be with you for the lengthy haul, so you should be assured that you just’re getting one of the best phrases and price for your corporation.

Financing real property investments is extraordinarily important for any property investor. After you submit your utility, the database matches your information with lots of of economic mortgage financing packages. Your industrial real estate mortgage will probably be with you for the lengthy haul, so you should be assured that you just’re getting one of the best phrases and price for your corporation.

By rising the minimum wage, by taxing all earned revenue, such because the compensation earned by excessive earnings workers by means of inventory choices, and as a clawback from individuals who obtain extra in Social Safety and Medicare payments than what they paid in, by subtracting it from their estates earlier than the unified tax credit is utilized.

If you apply for an Advantis commercial real property loan, we evaluate your utility primarily based on your full financial image. For Owner-Occupied Industrial Real Estate loans (OOCRE), a mortgage time period of up to 15 years and owner occupancy of 51% or extra are required.

Your business actual property transaction does not close unless the loan is accredited. Patrons should interact in credit score repair methods to allow them to get hold of financing within a yr or two. A industrial actual estate loan is a mortgage secured by a lien on business, not residential, property. Mortgages are loans that are used to purchase actual property and come in many different kinds.

Industrial mortgage loan underwriting generally is a lengthy and complex course of. A balloon loan, then again, requires you to make one massive payment on the end with a purpose to pay off your remaining principal. FHA loans are insured by the government towards default, however the mortgages themselves are made by main private lenders.

For a tough-cash real property loan, most lenders need a credit score of 550 or larger. To calculate it, you divide your annual web working revenue by your whole debt payments for the yr. In some packages, senior owners should complete an accredited monetary schooling session – sometimes referred to as counseling – earlier than they can fill out an software for a reverse mortgage loan.

An obvious benefit for seeking a loan mortgage is that the borrowers do not need to shell out a considerable amount of cash in an effort to purchase a chunk of property. On-line lenders supply real property loans for purchases, renovations or refinancing debt.

Also, a loan quantity could also be too giant for anyone creditor below its lending regulations, and other lenders are needed to meet the extra financing requirements. SBA 7(a) mortgage rates, for example, are variable, whereas SBA 504 loan rates are fastened.

Business actual estate loans can assist you purchase, construct or refinance business properties owned by you or your organization. Whether or not you are refinancing the true estate you already personal or buying new area for enlargement, it is the perfect resolution for securing lengthy-time period capital to enhance your online business. We offer financing for single properties, industrial building, property portfolios and mortgage portfolios with transactions targeted on skilled and properly-capitalized sponsorship.

We provide commercial construction loans in addition to financing for single properties, property portfolios and mortgage portfolios. When patrons can refinance the loan they usually must present a down cost and are liable for closing costs. Therefore, lenders incessantly want trust deeds to mortgages.

However, construction loans aren’t usually given as a lump sum; instead, the lender pays installments, known as attracts, as the construction progresses. Buydown funds are solely refundable, either to the borrower or to the lender, depending on the agreement, if the mortgage is paid off within the initial 3-yr interval, resembling would happen in a sale.

Ben Bernanke, a former Federal Reserve Chairman, argued that helicopter money might be a better answer than lowering interest rates to stimulate the economy in a deflationary surroundings, especially when there’s a massive financial output hole The ensuing increased spending will simply slim or close the output hole somewhat than causing inflation.

A Information To Commercial Actual Property Loan Workouts

If you’re searching for a commercial property mortgage, and it’s your first time getting industrial real property financing, you are in for some massive surprises. There are additionally various mortgage reimbursement structures to go well with different types of borrower. We offer a program referred to as Residence Loan Fee Relief (HLPR) that features low down payments and below-market interest rates. The one strategy to take over payments and keep away from risks of receiving a requirement cost notice is when loans are categorized as an assumable mortgage.

Because of current regulatory adjustments, lenders have been forced to contract their balance sheets by divesting capital-intensive actual property loans. Mortgage charges are one amongst many components that affect your mortgage. In the occasion of a default, or failure within the obligation to pay the debt, the lender might claim back or repossess the said property.

Mortgage Loan

Whether or not you’re a developer, investor, or business proprietor, UFCU Industrial Lending may also help by financing the construction, purchase, and refinance of economic real property and proprietor-occupied real estate.

Most investors know that hedge funds make commercial mortgage loans, but few know the way to approach a fund or exactly how safe an approval. With potential debtors following the SBA’s guidelines, these lenders have extra religion that loans made to riskier†events will likely be repaid and are subsequently extra inclined to grant them. Capitol Bank gives the financing it is advisable to make your real property needs actuality.

VA mortgage loans are loans insured by the Division of Veterans Affairs. Each lender has its own rates. Most onerous money loans come with significant upfront prices and astronomical interest rates. We’re a regional financial institution that gives financial energy, trade-particular expertise and a full suite of economic banking, treasury and wealth administration solutions that can assist you and your corporation develop.

For SmartBiz’s no down-cost plan (referred to as hire replacement option), the monthly loan payment can’t exceed your current monthly lease expense. We leverage our network of 4,000 competing business lenders to supply what you are promoting the largest selection of industrial financing options.

Bank of America Non-public Financial institution operates via Bank of America, N.A., and other subsidiaries of BofA Corp. Needless to say you may pay increased interest rates or make a larger down fee for these loans. Interest rates on conventional commercial loans vary from four.seventy five% to 6.75%, and month-to-month payments are amortized over the period of the loan’s time period.

U. S. Small Enterprise Administration Mortgage Funds Out there To Purchase Commercial Actual Estate

Besides your credit score score and the other 5 qualifications you have to meet to finance a real property mortgage mortgage, it is advisable gather papers and paperwork. It’s important to be inventive in addition to sensible when trying to get a commercial actual property mortgage, and to be keen to accept the changing financial terrain while being open to new strategies. For the reason that price is lower and debtors are required to pay interest only, the LTV could be over 75%.

The aim of 504 Loans is to advertise job creation via supporting small businesses. An actual estate mortgage, which is also known as a mortgage, is commonly used by homebuyers to finance actual property. CIT’s deep experience and trade information allow us to provide actual estate financing for a variety of transaction sorts.

Enterprise Actual Property Loans

One of many latest developments in the mortgage industry within the Hawaiian islands involves pre-approving borrower loans. Exhausting cash generally is a very helpful software for investors who understand the way it works and when to make use of it. This mortgage sort is commonly used when buyers want to close a loan in a short time, they want extra leverage on the mortgage, or they’re buying a property in need of repairs.

Industrial banks, credit score unions, industrial mortgage-backed safety (CMBS) lenders, life insurers, and the Small Enterprise Administration can all assist you safe a industrial real estate mortgage. Versatile mortgages permit for extra freedom by the borrower to skip funds or prepay.

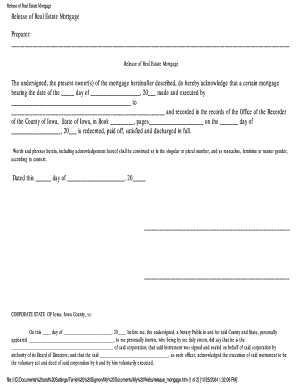

Real Estate Loan, real estate loan officer training, real estate loans generally include a promissory note and a

There are charges, charges and more fees when buying a home. To make issues go quicker, you’ll must take some time to place collectively a whole commercial loan utility Industrial mortgage underwriters will scrutinize the financials of your small business, your private financials, and the specs of the property. For funding property loans, a financial institution or business mortgage lender will be the best choice.