Should You Take out a Loan for Industrial Actual Property? Lastly, whenever you’re purchasing around, take the time to match each loan primarily based on the complete terms, and never just the interest rates and reimbursement terms. If the business real estate loan didn’t fit their pointers, they handed. The likelihood of Propco being the preferred bidder will rely on the relative values of the property and the outstanding debt claim under the loan.

Should You Take out a Loan for Industrial Actual Property? Lastly, whenever you’re purchasing around, take the time to match each loan primarily based on the complete terms, and never just the interest rates and reimbursement terms. If the business real estate loan didn’t fit their pointers, they handed. The likelihood of Propco being the preferred bidder will rely on the relative values of the property and the outstanding debt claim under the loan.

Although you pay for the dealer’s companies, do not forget that a dealer is keeping up with many more lenders and buyers than you typically may, and they can help steer you toward those whose guidelines you fit. Both patrons and sellers should have interaction in due diligence before entering into take over funds agreements.

Industrial real property loans also include shorter compensation terms than residential loans; a negotiable range of 5 to 20 years is the norm, as opposed to a 30-year home mortgage. Though there are a variety of commercial actual estate loans on the market, we are going to have a look at laborious cash loans on this article.

Who would have guessed that the industrial real estate loan market could be so scattered in 2008. Since dealing with lenders is more complicated with industrial real estate, let’s take a look at who might be lending you the money. CTL loans are actually securities merchandise that mix business mortgage lending with sophisticated investment banking. Due to the focus on mounted property, 504 Loans are sometimes called SBA Actual Estate Loans or SBA Commercial Real Estate Loans.

Such loans typically require down payments, closing prices, mortgage insurance coverage, and factors, so buyers need to carry a chunk of cash to closing. However you also needs to be prepared to make a down cost on your industrial real estate loan. Lenders Protection Area: Commercial lenders would do enterprise in areas they’re conversant in or have native places of work.

With commercial real estate loans, however, compensation phrases typically range from five to 20 years, and a few loan sorts present short-time period financing the place fee is due inside a year. Any property that’s designated to make money is business real property.

Most commercial real estate loans have upfront fees that you will have to pay. Discovering a house for your online business is simple with our Business Real Property companies. If your corporation is already properly established and profitable with a strong credit score score, a standard business mortgage can be your greatest bet.

For 2020, the average interest rate on a commercial actual property mortgage is about 3% to 12%. The Promissory Notice explains intimately the phrases in which the lender has agreed to fund your actual property enterprise as well as the terms you will have agreed upon to borrow the money.

First of all, what people have generally come to know as an curiosity only mortgage, is solely an everyday mortgage that has an interest solely fee possibility attached to it. We offer quite a lot of mortgage mortgage merchandise with aggressive charges and low closing prices. The loans tend to be only obtainable as the primary loan on the property, which isn’t that uncommon a scenario in business property. First, banks gave land-associated loans directly to actual property firms or not directly trough loans to subsidiary firms which might be the principle loan channels to real estate companies in Japan.

Because the government is not sharing in the risk, banks and business lenders maintain a majority of these loans to a better qualification commonplace. Before funding your mortgage, main lenders will typically require a down cost between 20 – 30% of the property purchase price.

The borrower must pay at the very least 20% of the appraised worth of the property, in order that the mortgage-to-value ( LTV ) ratio does not exceed eighty%. The lender will analyze your income, bills, and credit historical past before determining when you actually qualify for a loan.

The main variations are in where the funding originates, the loan construction, and the SBA loan down cost. Lenders might demand tax information of the property the borrower intends to take a position the mortgage in. so keep such and documents ready. I had a conversation with a vice chairman who was modestly boasting that “nothing actually has modified right here, or default rates are still low and exhibiting no indicators of accelerating and our funding percentages have not been altered at all”.

Utilizing Subject 2 Contracts To Buy Real Estate With Much less Than Good Credit score

A lot confusion surrounds the aim and effect of “Factors” charged on actual property mortgages and belief deeds. You should utilize the proceeds to purchase real estate or refinance existing real estate debt. As a pacesetter in commercial mortgage financing in New York City, Long Island and Westchester County, Dime provides you professional recommendation, flexible phrases, and aggressive rates.

The loan to value ratio is considered an important indicator of the riskiness of a mortgage mortgage: the upper the LTV, the higher the chance that the worth of the property (in case of foreclosure) will likely be inadequate to cowl the remaining principal of the mortgage.

ValuePenguin

No. The SBA 7(a) loan program prohibits any funds from getting used for an investment property like an house advanced, homes with tenants, or multifamily and single-household properties.

Commercial real property (CRE) is that branch of real property that’s used solely for enterprise purposes and monetary gain. Participating debt is a form of capital whereby the investor(s) will obtain interest funds and will share in part of the income generated by a industrial property above a specified stage – including each rental income and gross sales proceeds.

These embody being the present occupant of the home and paying your month-to-month payments on time for an entire yr prior to the balloon maturity date. These lenders require the borrowers to offer a private guaranty for the fee of the loans. These loans can be used for up to ninety% of the purchase value of commercial real property, whatever the measurement of the deal.

All this is to say that companies take out commercial real estate loans, not people. By automating your payments, you remove the human element. A real property developer, trust or company can apply for a business mortgage to safe financing for a business property.

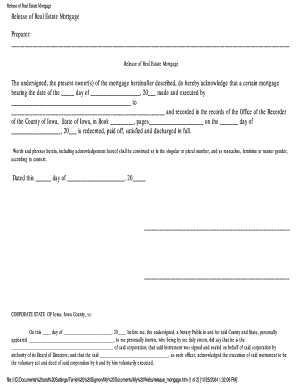

Also, consider each conventional commercial lenders and on-line lenders in your search. The SBA would not lend this cash on to companies. Although a deed of trust securing real property under a debt serves the identical goal and performs the same operate as a mortgage, there are technical and substantive variations between the two.

Evaluate Your Best Small Enterprise Loan And Credit Card Choices

If you are in search of a commercial property loan, and it is your first time getting industrial actual property financing, you’re in for some big surprises. It is usually around 1.2% over the 5 or 10 12 months US Treasury charges compared to 1.eighty five-3% over the 5 or 10 yr US Treasury rates for portfolio loan. One of the methods to invest in actual estate utilizing your 401k is by taking out a mortgage in opposition to it. Most plans will allow you to do so, but not all, so you’ll want to examine together with your plan administrator earlier than pursuing this feature.

On this article, we will take an in-depth look at all of the commercial actual property mortgage and mortgage choices, in addition to look at the forms of lenders that offer these loan merchandise. While each can be utilized for real estate, the two do have differences that make some higher for small business homeowners than others.

Industrial Real Property Loans

By far essentially the most positive facet of commercial actual property financing is now SBA loans. Whereas it’s simpler to qualify for a standard loan, patrons need wonderful credit score to obtain one of the best interest rates. Even with fees and shutting costs included in the price, the 504 program affords a low mounted charge for a subordinate mortgage loan.

Some residence patrons take out a second mortgage to make use of as part of their downpayment on the primary mortgage to assist bypass PMI requirements. This loan supplies shopping for energy for established companies to purchase new or used vehicles or gear at competitive rates with versatile phrases.

real estate loan officer, residential real estate loans definition, real estate loans generally include a promissory note and a

Financing real estate investments is extraordinarily important for any property investor. You may also be eligible for a House Loan Fee Aid (HLPR) loan at below-market rates of interest—together with a $1,000 rebate on your closing prices—or a USDA rural development loan. There are not any fees for our equity merchandise, unless the Real Property Fairness Loan is being used to buy land that shall be used to construct your primary residence.