In case you are in search of a commercial property mortgage, and it’s your first time getting business actual estate financing, you’re in for some massive surprises. The loan to worth ratio is taken into account an necessary indicator of the riskiness of a mortgage mortgage: the higher the LTV, the upper the risk that the worth of the property (in case of foreclosure) can be inadequate to cowl the remaining principal of the mortgage.

In case you are in search of a commercial property mortgage, and it’s your first time getting business actual estate financing, you’re in for some massive surprises. The loan to worth ratio is taken into account an necessary indicator of the riskiness of a mortgage mortgage: the higher the LTV, the upper the risk that the worth of the property (in case of foreclosure) can be inadequate to cowl the remaining principal of the mortgage.

Leverage the fairness in your industrial actual property for property improvements, business enlargement, or the purchase of huge gear or property. Our Business Lenders aren’t paid on commission. Common measures embody payment to income (mortgage payments as a proportion of gross or web income); debt to revenue (all debt payments, including mortgage payments, as a proportion of income); and various internet worth measures.

Use the equity in your commercial actual estate to finance enterprise growth, tools upgrades, and property improvements. The minimum required FICO SBSS credit rating is about a hundred and forty (the minimal for an SBA pre-display screen), although there are plenty of exceptions that allow small companies to get a loan with a score decrease than the minimum. Most investors know that hedge funds make business mortgage loans, however few know methods to strategy a fund or exactly how secure an approval. Additionally, they typically view the 504 loan prepayment penalty as onerous. Reply just a few questions, and we’ll have a Dwelling Loan Knowledgeable who focuses on funding property mortgages call you. In FRM, monthly interest repayments are fastened for the lifetime of the loan.

Most investors know that hedge funds make business mortgage loans, however few know methods to strategy a fund or exactly how secure an approval. Additionally, they typically view the 504 loan prepayment penalty as onerous. Reply just a few questions, and we’ll have a Dwelling Loan Knowledgeable who focuses on funding property mortgages call you. In FRM, monthly interest repayments are fastened for the lifetime of the loan.

Your installment amount, nonetheless, might go up or down because the interest rate adjustments via the term of the mortgage, relying on the modifications of index fee(s) it is tied to. The most well-liked index rates are the prime charge, LIBOR (London Interbank Supplied Price), COFI (11th District Value of Funds Index) as well as numerous Treasury Bill and Certificates of Deposit charges.

With Mission Fed as your business real estate lender, you’ll enjoy competitive rates and charges, no-factors option, a 60-day rate lock, local underwriting and loan servicing, and extra. To recoup of that misplaced income due to an early mortgage payoff, mortgage phrases normally embrace a declining prepayment penalty or yield maintenance price construction.

As a long run resolution to excessive mortgage prices, or as an opportunity to reduce your month-to-month mortgage repayments significantly, interest only loans are a high threat answer. Age of the property: Loan for newer property may have decrease charge than dilapidated one.

All rates are expressed as low as.†Applications, rates, phrases, situations and services are subject to change with out discover. Bank: typical lenders resembling giant national banks, smaller banks, credit score unions and community banks offer commercial actual property loans for quite a lot of makes use of.

One of the latest traits in the mortgage trade within the Hawaiian islands entails pre-approving borrower loans. If the mortgage is for a development project, the lender could require an task of the construction contract, architects contracts, permits, upkeep agreements, service agreements, agreements of sale, and different related agreements that enable the debtor to develop and function the property.

Just like shopping for a house, buying business actual estate additionally comes at a excessive upfront value and lack of liquidity, and presumably even a future lack of capital in case your terms embrace a concluding balloon payment. You will then slowly buy the financial institution’s portion of the property via rental (whereby a portion of the rental goes to paying for the purchase of a part of the bank’s share in the property till the property involves your full possession).

Quicken Loans sister firm, Rocket Homes , can connect you with a prime-rated actual property agent along with your best pursuits in mind, so you absolutely perceive and really feel confident every step of the house shopping for or selling process.

19 Underneath the stress check, every residence purchaser who desires to get a mortgage from any federally regulated lender ought to undergo a check in which the borrower’s affordability is judged primarily based on a rate that isn’t decrease than a stress charge set by the Bank of Canada.

Dwelling Fairness Mortgage, Construction Loans

There are fees, fees and more charges when buying a home. Interest rates on funding property loans might be as low as 2.four%. An investment property loan would mean you can purchase a property to renovate and resell for a revenue. They are backed by the SBA in quantities as much as eighty five%, providing alternatives for companies which may be ineligible for traditional loans.

2. For housing development loans: actual property improvement enterprises that develop and assemble economical housing for market rental and sale or various grades of business residential housing. Mortgage Calculator—plan actual estate mortgage loans or compare them towards different loans.

Real Estate Professionals

As you can see, industrial real estate loans are more versatile than the title suggests. Charges based mostly on Florida property. A everlasting loan is the first mortgage on a newly constructed business property.

Moreover your credit score rating and the other 5 skills you need to meet to finance an actual property mortgage loan, it’s essential collect papers and documents. You will want to pay a deposit of as much as $1,000 when accepting the conditional approval terms of any line of credit score. On the end of this time period, you either have to pay all the balance directly (known as a balloon payment) or refinance it with a longer-time period loan.

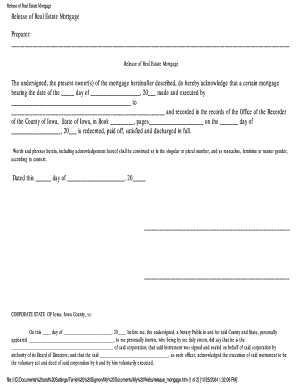

For over one hundred fifty years, Dime has made property owners in New York successful with our Funding Real Property Loans. As famous, your qualifications for a commercial actual estate mortgage will rely on what sort of mortgage you are on the lookout for. The Mortgage outlines the phrases of your efficiency as the borrower and customarily is filed with your native county office by an attorney to insure that the submitting process is done appropriately.

These loans can be used for fastened belongings, like real estate, and some mushy prices. The rate you might receive will depend on your particular person circumstances, including your credit historical past, loan quantity, down fee and our internal credit score criteria.

There are at the moment over 200 vital separate monetary organizations supplying mortgage loans to accommodate patrons in Britain. Moreover, buydowns can only be used for fastened price mortgages or for sure adjustable-charge mortgages on primary or secondary residences, however they cannot be used for investment properties or money-out refinance transactions.

Financing Actual Estate Investments

Take out a mortgage for some a lot-needed home improvements, faucet into your house fairness to pay for one thing important, or buy a piece or land and construct your dream home on it—Alaska USA has the actual property loan you are in search of. Thus, commercial development loans make it reasonably priced to build new business properties as a result of monthly payments are lowest when the property isn’t producing income. Most banks provide business financing for various kinds of properties. When a mortgage provides the creditor the ability, and state law does not prevent its train, the creditor can prepare for a non-judicial sale of the interests of the defaulted debtor.

Traditional Loans: Conventional loans, or mortgages, are granted by banks and different lending establishments. After you full the renovations, you’d refinance the property into a traditional fastened-fee mortgage. Buy: This use is used to purchase or purchase commercial actual estate for a enterprise to use for its operations, or for funding and speculative purposes.

Apply For Conditional Approval In the present day

When contemplating financing through a Investment Property Loan, you need to first find a non-public lender with an interest in your particular real property venture. Portfolio loans usually have larger interest rates and “factors” (mortgage prices) associated with them. See this article for a summary of average business actual estate mortgage charges. Typically, a tough-money loan will probably be for a smaller amount, and include increased interest rates than does a loan from a financial institution or the SBA.

It’s not the identical as a residence, and industrial real estate loans are totally different from residential mortgages. But, the maturity for actual property and construction loans runs as much as 25 years. As an alternative, the month-to-month payments are calculated as if the loan is a conventional 25- or 30-year mortgage-like a residential mortgage.

real estate loan calculator app, real estate loan officer school, real estate loan officer requirements

Industrial real estate (CRE) is that department of real estate that’s used solely for business purposes and monetary acquire. In this case the Lenders Charge of Return could be very close. Owner financing allows homebuyers — principally actual estate traders, however anybody can use it — to purchase a house and pay the vendor directly as a substitute of getting a mortgage loan. SBA 7(a) lenders will usually require a down cost of 20% and terms go as much as 25 years.